How to end low-wage work forever

A policy that is direct, efficient, and life-changing

Few goals command more bipartisan support than raising the pay of low-wage workers. Across all levels of government and across both political parties, the promise of delivering better jobs and pay for those left behind by the economy has become ubiquitous.

And for good reason.

Roughly 21 million American workers earn less than $16 an hour.1 Two-thirds of those workers are women. And among men in their prime working years (ages 25–54), nearly 10 million, or 14 percent of them, don’t have jobs at all. In some states, like Louisiana and West Virginia, one out of five working-age men are jobless.

In short, the labor market has left too many people with either low pay or no pay at all.

Policymakers have tried to help. But the specific ideas they have traditionally suggested to realize the goal of better jobs and higher pay for these workers — from minimum wages to tax credits to Buy American rules to “no tax on tips” — have been poorly targeted, expensive, or likely to cause unintended consequences that undercut other policy objectives.

Luckily, a better idea already exists. Indeed it has been around for decades. It is the one policy that is efficient, directly helps workers without undermining other goals, and is better aligned with market incentives than other policies: a wage subsidy.

What is a wage subsidy?

In its most basic shape, a wage subsidy is exactly what it sounds like: the use of public funds to raise the wages of low-wage workers. If designed correctly, it increases the benefits to workers of getting a job and working more hours, and it does so without discouraging businesses from providing those jobs and hours.

The purpose of the subsidy is to replicate the condition of full employment — an abundance of jobs that offer decent wages — for both workers who are paid the smallest wages and potential workers who don’t have a job, including those who aren’t even looking for a job because the only jobs available to them are so badly compensated.

Nobel Prize winner Edmund Phelps is the economist most closely associated with the idea, having first proposed a wage subsidy back in 1994.2 Different versions of the idea have since then demonstrated bipartisan appeal. Conservative populist Oren Cass recently offered his own proposal for a wage subsidy, as did Senator Josh Hawley. During the Covid pandemic, the left-leaning Roosevelt Institute proposed a Fair Wage Guarantee, by which employers would be given a tax credit to incentivize them to hire recently laid-off workers and pay them the same wages as before they lost their jobs. The U.S. government has actually tried a few policies similar to a wage subsidy in the past.3

But neither the earlier proposals nor the attempted policies have struck the right balance of market integration, low administrative burden, and wage support. Nobody has nailed the design yet.

How should a wage subsidy be designed?

In our version of a wage subsidy, the government sends money directly to low-wage workers in every single paycheck, raising their hourly wage.

Our proposal is straightforward and has three main components:

1. The target wage.

To start the calculation of how big a subsidy to send a given worker, a wage subsidy policy needs a target wage. The target wage can be thought of, roughly, as the wage towards which the new subsidy will boost the current wages paid to workers by their employers.

We have chosen 80 percent of the national median hourly rate as the target wage.4 In 2024, for example, the median hourly wage of employees paid hourly was $20,5 which would set the target wage at $16.

Our rationale for choosing $16 per hour is that we wanted a number high enough to eliminate the temptation to use any other policies, such as raising the minimum wage, to boost wages for low-income workers. Those other policies are more economically costly than the wage subsidy, as we explain in detail below. But with a sufficiently high target wage, the political pressure to accompany the wage subsidy with worse ideas will be alleviated. (It’s certainly possible to make the case for a target wage that’s either higher or lower than $16, and we would be happy to hear those arguments.)

2. The subsidy amount.

We propose that the government pay 80 percent of the difference between a worker’s current wage and the target wage.

A simple way to remember the first two components of the wage subsidy is by the 80-80 rule. The government subsidizes 80 percent of the difference between the worker’s employer-paid wage and 80 percent of the national median wage.

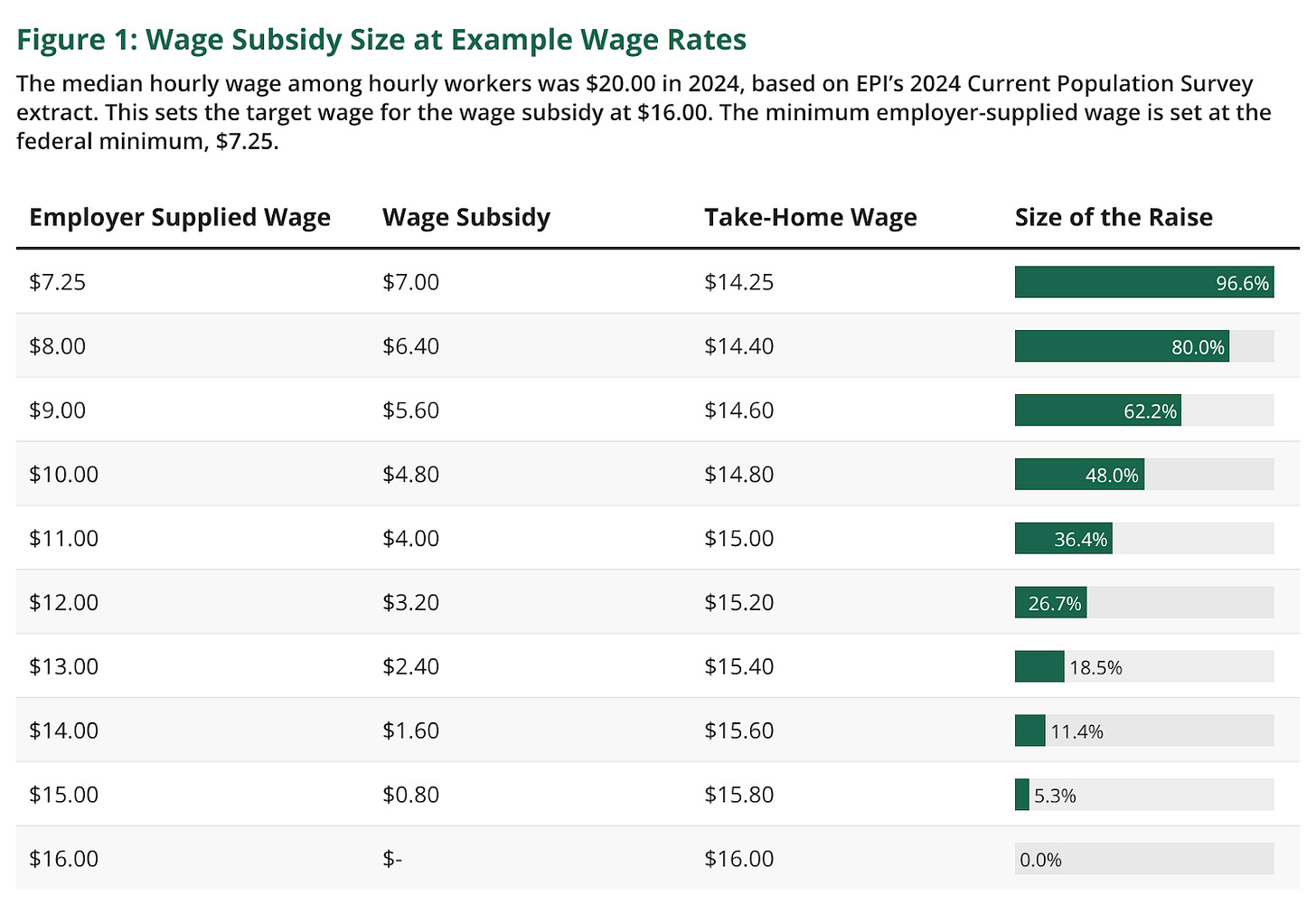

We show the math — how workers at different wage levels will benefit from the subsidy — in Figure 1:

The wage subsidy would reset the low-wage labor market across the country:

A worker earning $8 an hour from their employer would make $14.40 after the wage subsidy.

A worker earning $12 an hour would get a bump to $15.20 from the subsidy.

A worker earning $15 an hour — already close to the target wage of $16 — would still get a boost, though a smaller one, to make $15.80.

And so on. The subsidy is biggest for those workers making the least from their employers, but at no point does a low-wage worker get a subsidy so big that they leapfrog workers who make higher employer-paid wages.

Why stop at 80 percent? Why not just have the subsidy pay 100 percent of the difference between the employer wage and the target wage? The reason has to do with preserving the right incentives. We can best illustrate the point with a hypothetical example.

Imagine that Jimmy is paid $8 an hour by his employer, Freaky Foods, a restaurant. Under a 100 percent wage subsidy, he earns a total wage of $16 an hour in his biweekly paycheck.

Even if Jimmy works hard and shows real promise, Freaky Foods has no incentive to give him a raise and start paying him $11 an hour — because if the wage subsidy covers the entire difference between his Freaky Foods wage and the target wage, Jimmy would still be earning the exact same total wage of $16 an hour regardless of whether he gets the raise or not.

Freaky Foods may as well keep paying Jimmy the lower wage and let the government pick up the difference. And for his part, Jimmy has no financial incentive to keep performing well, as he will get paid the same $16 an hour no matter how brilliantly he does his job.

Now consider our proposal, where the wage subsidy covers 80 percent of the difference, as shown in Figure 1. If Freaky Foods pays Jimmy $8 an hour, his total wage after the subsidy climbs to $14.40 an hour.

If Freaky Foods then raises his wage to $11 an hour to reflect his excellent performance, the wage subsidy will bring his total wage to $15 an hour.

Whenever Jimmy gets a raise, his total wage also goes up. Which means that he has an incentive to keep working hard, and Freaky Foods has an incentive to offer raises to its best workers.6

But to ensure that the wage subsidy has these desired effects, one final component is needed.

3. The base wage.

To prevent fraud, a wage subsidy needs a base wage, which is the minimum amount that an employer must pay an employee in order to qualify for the wage subsidy. We propose setting the base wage equal to the federal minimum wage, which is currently $7.25 an hour.

Without a base wage, enterprising criminals might try to milk the government’s wage subsidy by creating fake jobs for their “workers.” Freaky Foods, for example, could pay Jimmy $0 an hour, and he would then receive a wage subsidy from the government of $12.80 an hour (which is 80 percent of the full $16 an hour). Because Freaky Foods pays no wage at all, they could "hire" Jimmy to do a fake job that requires no work, earning him a $12.80 an hour subsidy — from which he can send Freaky Foods a kickback. The absence of a base wage would create the possibility of a win-win fake job arrangement, in which the only loser is the defrauded American taxpayer.

In contrast, with a base wage of $7.25 an hour, Freaky Foods will only hire Jimmy if the work he is doing really is worth at least $7.25 an hour. The reason is that the base wage of $7.25 is greater than the maximum wage subsidy, which is $7 (see Figure 1 again) — meaning that it would be impossible for Freaky Foods to receive a kickback higher than the amount they have to pay Jimmy.7

Put another way, a base wage makes fraud unprofitable.

For workers, a base wage of $7.25 translates to a minimum take-home wage (which includes the wage subsidy) of $14.25, which means that the lowest-paid worker in the American labor market right now would be making almost twice as much per hour after the subsidy was introduced.

And yet employers pay none of the cost of the subsidy, so there is no risk that they will try to hire fewer workers or raise the prices of the products they sell.

We want to be clear that we are not making a bigger point about the merits of a higher or lower standalone minimum wage. Economists and pundits and policymakers constantly debate whether a minimum wage above a certain level has a disemployment effect. That is not a debate we are wading into here.

A minimum wage reflects the minimum amount that a worker must receive, whereas a base wage reflects the lowest wage that an employer must pay. Those two concepts differ when a wage subsidy exists to boost the amount a worker is paid above the amount that an employer has to pay.8

We are strictly making the case that a base wage is needed to prevent fraud as part of a new wage subsidy.

Why a wage subsidy is the best path forward

The median American worker is doing better today than in the past, not just earning higher real wages but also saving more for retirement, gaining access to more job benefits like sick leave, and working in safer environments.

But it is equally true that some groups of workers have missed out on the prosperity enjoyed by that typical worker. Often based on where they live, or on their socioeconomic and demographic backgrounds, their wages and job prospects have lagged.

The economy of the past several decades has also shown that full employment can deliver strong real wage growth and the kinds of job opportunities that other policies struggle to bring about. The typical worker does best when labor markets are tightest, as do the lowest paid workers.

When a recession hits and full employment disappears, however, the lowest paid workers are the first to lose their jobs and the last to be rehired.9 They essentially work in a different, more precarious labor market than the typical worker does, with recessions that are longer and more severe.

A clear step to jump-starting the vitality of these struggling labor markets is therefore to use tools that can produce and sustain tight labor markets for low-wage workers and for those potential workers who are excluded from the labor force altogether.

The wage subsidy is the most direct and effective tool available. The entire subsidy goes to workers. And with a subsidy that raises the total wages of the least-paying jobs by as much as 80 percent, the subsidy is also big enough to encourage jobless adults who are not even looking for work to enter the labor force.

A wage subsidy also avoids the costly and ineffective bankshot attempts embedded in other policies (see below) to indirectly boost wages.

Under our proposal, for a worker who today earns $8 an hour, the wage subsidy’s cost to taxpayers is $12,800 per year.10 For the $12 an hour worker, the cost falls to just $6,400 per year.

Looking at the costs of indirect wage-boosting ideas shows the stark difference:

Strengthening Buy American provisions, which force federal agencies and their contractors to buy only goods with a minimum share of parts made in America, would cost at least $154,000 per job created.

State and local governments will sometimes offer incentives to businesses to create jobs. One estimate places the average cost of these incentives at $106,000 for each job that the businesses receiving the incentive promise to create. Another estimate found an even higher average of $196,000 per job actually created.

At the most extreme reaches of the cost spectrum are policies like steel tariffs, which cost $900,000 per job created.

Mandates aimed at raising worker pay, often included in policies such as the Infrastructure and Jobs Act, are also an ingredient of the “everything-bagel” policy approach that raises the cost of infrastructure and the provision of public goods. The principal goal of policies like these is to improve the supply side of the economy, but adding a wage mandate distracts from and even contradicts that goal.

If, however, a separate wage subsidy existed, policymakers would feel less pressure to boost wages indirectly through such mandates. Other policies would be unburdened, free to pursue their stated goals with the kind of single-minded focus that, for example, the recent Abundance movement has been calling for. (See the Appendix below for a detailed discussion of why other ideas are less effective than a wage subsidy.)

Yet another key benefit of the wage subsidy is that it is scalable. In fact it scales automatically. If low-paying jobs become a bigger share of the labor market — in response to a recession or the natural rise and fall of different sectors of the economy — then the wage subsidy kicks in for those new jobs.

And if necessary, the range of wages it applies to can easily be changed by policymakers. That flexibility holds true in the often cited risk of large-scale job displacement from Artificial Intelligence and other technologies.

Whether or not AI and automation will cause massive disruptions to the labor market, perhaps forcing workers to switch to new and lower-paying jobs, is unknown. But it is at least a risk. If it does happen, labor market policies such as re-skilling and workforce training may help on the margins, but they will be tough to scale if the effects are truly big.

Policymakers can expand the effects of the wage subsidy, reaching more workers, just by widening the range of wages that qualify for it. It is a scalable labor market policy that can meet the challenges of a dynamic future.

Isn’t the EITC basically a wage subsidy?

The Earned Income Tax Credit (EITC) is a refundable tax credit that workers can receive if their annual income falls below certain thresholds. The obvious similarity it shares with a wage subsidy is that both use federal funds to help low-income workers, so it is natural to ask why we advocate for a wage subsidy given that the EITC already exists.

The answer is that a wage subsidy avoids the problems embedded in the design of the EITC.

As a tax credit, the EITC is only paid to the worker once a year, and only after the worker’s tax returns have been filed. The amount of the EITC payment itself is determined by a complex formula. The resulting uncertainty means that it's not clear how big of an EITC check a worker will receive when deciding whether to apply for a job or work more hours. And because the EITC arrives as a single annual payment, the worker also loses the feeling that the extra money is part of being compensated for working. It feels much more like a handout.

The wage subsidy, in contrast, arrives with every single paycheck. And the amount of the subsidy, which is paid per hour of work, is solely determined by how much an employer pays the worker. In fact, employers could advertise the post-subsidy wage amount in job advertisements.

All of which helps the wage subsidy feel more like real pay than the EITC, making it more transparent and immediately increasing the returns to work in the eye of the worker. A subsidy that feels like an earned wage would do a better job of incentivizing people to both enter the workforce and to work more once they’ve entered. (There is some debate about the EITC’s success at pulling in workers off the sidelines. The evidence suggests that for at least some groups, especially workers without children, the EITC has little effect on whether and how much they work. Indeed, a strain of research seeks to explain why the impact on hours worked is smaller than we might otherwise have expected.11)

Another problem with the EITC is that it is kludged together with family policy, which leaves many workers falling through the cracks. Specifically, the amount of the EITC payment depends on the number of children in the household, and childless adults receive very little benefit. This helps workers who already have families, but it does nothing to help put people on the pathway to afford starting a family. A wage subsidy, on the other hand, does not discriminate between workers with children and workers without them.

Lastly, the EITC can disincentivize full-time work, thus failing to provide a clear path to economic self‑sufficiency. The amount of the credit is determined by total annual income, and therefore the EITC payment declines quickly with each additional dollar earned once a worker’s hours climb above a certain threshold. This dynamic penalizes low-wage workers, for example, who shift from part-time to full-time work. The very feature of the EITC that directs help to low‑income workers also distorts the reward for escaping low‑income status altogether.

As already explained, the design of the wage subsidy avoids this flaw. Precisely because the wage subsidy is tied to wages, the amount of the subsidy never declines even as the worker takes on more hours. Workers don’t get penalized for increasing their annual incomes.

Not just math

As we emphasized in the comparison between the wage subsidy and the EITC, an ideal policy should replicate not just the higher wages but also the feel of a strong labor market, in which hard work is generously rewarded, and workers feel good about their professional futures.

For that to happen, the policy cannot be perceived as a handout.

A wage subsidy has a far better chance of integrating with the normal process of how workers are compensated than any other idea. It can be paid to workers in such a way that it cannot be distinguished from a worker’s paycheck. It can be added to a worker’s wages as seamlessly as a payroll tax is withheld.

Much work remains to be done in hammering out the details of this policy. For example:

What is the net fiscal cost of a wage subsidy for a given target wage, and how does it compare to the total costs of other programs?

What are the social returns and spillovers to increasing employment?

Which groups of people and which specific places would benefit most from this policy?

How would a wage subsidy’s impact vary over the business cycle?

How should it either complement, reduce dependence on, or replace other work-oriented programs?

Does the administrative capacity already exist to implement such a direct-to-paycheck policy?

Our hope is to inject the idea of a wage subsidy back into the public discourse so that these details can be fleshed out.

When the design is right, the wage subsidy will be like any other dollar earned, consistent with the conviction of so many workers that there is dignity and pride in earning a good living, a satisfaction in working one’s way out of trying circumstances and into a better life.

Appendix: why other approaches don’t work

The existing policy ideas aimed at improving the labor market for the lowest-earning workers tend to have at least one of three major flaws, all of which are avoided by a wage subsidy.

Flaw #1: The policy makes it harder to hire more workers.

Employers often refrain from hiring low-wage workers not because they don’t need the workers, but because there is a mismatch between how much the employer is willing to pay and what the worker needs to get paid to make the job worthwhile.12

In the language of economics, jobs go unfilled because a worker’s reservation wage is higher than the wage a firm will offer to pay that worker.

A wage subsidy bridges that gap.

By having the government add to a worker’s employer-provided wages, workers will find that their total take-home pay now rises above their reservation wage. This mechanism is how the wage subsidy makes possible more matches between workers and employers that are mutually beneficial.

Firms have a chance to meaningfully increase hiring, getting the workers they want at wages they can afford to pay.

Workers receive a higher hourly compensation that reflects their needs and preferences, turning those unfilled job openings into higher-paying job opportunities.13

The better matching between employer and worker brings other benefits as well. The ability to hire more workers (at each given wage level) without increasing costs means employers can also afford to add extra shifts to lighten the load on existing workers and reduce burnout. Or they can make their workers’ schedules more stable, less precarious.

Other policies, however, fail to close the same gap between potential workers and employers — and they actually end up reducing the demand for more workers. Such policies include minimum wages, expanded fringe-benefit mandates, and a variety of others that raise the cost for businesses to hire and therefore shrink the set of jobs that they are able to offer.

A policy that aims to simulate the conditions of full employment should ensure that labor demand is not weakened by the policy itself. There is no substitute for employers wanting to hire lots of workers.

A policy that creates strong labor markets for low-wage workers is one that by definition increases the incentive for the workers to pursue new jobs and work more hours, and makes it financially possible for firms to hire those workers. In other words, it should help workers to work and businesses to offer them work.

A wage subsidy meets that standard. Other policies fail it.

Flaw #2: The policy fails to increase the financial returns to work.

Why would potential workers — people who are neither working nor looking for work — come off the sidelines and get into the labor market if it doesn’t benefit them? Why would workers who already have jobs choose to work longer hours if their situation won’t change?

Some policies fail to offer financial incentives and simply attempt to cajole people into working. Adding more work requirements to welfare payments, for example, doesn’t actually make the work pay better. Work requirements often add more administrative bloat to an already clumsy bureaucracy.14

And policies such as a Universal Basic Income — which pays the same recurring amount of money to everyone at regular internals, regardless of whether they work — don’t even attempt to increase work or the returns to work.

State and local incentives to help a business create jobs in a given region, meanwhile, might increase demand for workers in that specific place, but generally at the cost of workers in another place where the business would have otherwise been located.

Through the decades, federal and state governments have also built out a variety of overlapping safety-net programs for low-income workers. Many of those programs are now characterized by phaseouts of the benefits they offer in addition to benefit cliffs, meaning that as a worker earns more money from their employer, the decline or elimination of the benefit offsets much of that extra money. (These offsets are in addition to the higher marginal tax rates that all workers pay as they earn higher incomes.)

The combination of these phaseouts and benefit cliffs — spread across the various different safety-net programs — represents a higher effective marginal tax rate for low-income workers. As described by the Congressional Budget Office, this higher rate is “the percentage of an additional dollar of earnings that is unavailable to a worker because it is paid in taxes or offset by reductions in benefits from government programs.”15

A high effective marginal tax rate creates perverse incentives, encouraging low-income workers to work less, because the benefit of working more is so diminished.16

As we’ve already discussed, the wage subsidy does not introduce a benefit cliff, nor does it introduce a higher effective marginal tax rate when a worker earns a raise from their employer.

Flaw #3: The policy tries to micromanage the economy.

Tariffs, Buy American provisions, state and local business incentives — these and other similar policies target specific sectors of the economy to be helped.

In doing so, they often just end up reducing competition, harming downstream industries, raising the cost of public goods, or possibly even harming the very workers that the policy is supposed to help.17

An explicit aim of the Trump administration’s tariff policies, for example, is to create manufacturing jobs for non-college workers in the regions where such jobs have been decimated. Even if tariffs do recover some manufacturing jobs, itself a dubious claim, there is little reason to think that those jobs will go to the workers targeted by the policy.

Policies that single out a sector or region have a poor track record. And when they do manage to create jobs, those jobs come at a very high cost18 — making these policies especially unappealing given the country’s fiscal trajectory.

You can download a PDF version of this post here.

Low-Wage Workforce Tracker, Economic Policy Institute, May 2025. Analysis of the Economic Policy Institute Current Population Survey extracts, May 2024 through April 2025. Wages include overtime, tips, and commissions.

Phelps, E. S. (1994). Low-Wage Employment Subsidies versus the Welfare State. The American Economic Review, 84(2), 54–58. http://www.jstor.org/stable/2117801

The Job Opportunities in the Business Sector (JOBS) program focused on encouraging employers to hire young and less educated workers. It offered $3,200 per employee and covered 93,000 positions. The WIN tax credit aimed to subsidize employment for recipients of the Aid to Families with Dependent Children (AFDC) program. Both JOBS and the WIN tax credit found themselves hampered by administrative burden. The New Jobs Tax Credit (NJTC) provided a tax credit for firms that increased their employment by more than 2 percent compared to the previous year. The credit covered the first $4,200 of an employee's wages or $100,000 per firm. It successfully increased construction and retail employment. The Targeted Jobs Tax Credit (TJTC), which replaced the NJTC, aimed for targeted support, using vouchers and providing a tax credit for employers. Unsurprisingly, the TJTC saw limited utilization due to administrative barriers and stigma associated with vouchers. Temporary Wage Subsidies for On-The-Job Training in JTPA Title II provided a subsidy of 50 percent of a worker's wages for up to six months, intended to support the hiring and training of otherwise disadvantaged workers. AFDC-targeted programs, such as the National Supported Work Demonstration (NSW) and the Homemaker-Home Health Aide (HHHA) program, offered subsidized employment and support services. The United States has also tried a place-based wage subsidy program. The 1993 Budget Reconciliation Bill included a program in six urban and three rural Empowerment Zones, providing a 20 percent tax credit for the first $15,000 of wages for employers. This resulted in a significant increase in employment and earnings among workers.

Why have we chosen this value? The target wage — 80 percent of the national median wage for hourly workers, or $16 using the 2024 median wage — offers a significant increase on the current federal minimum wage of $7.25 an hour, and also goes beyond traditional minimum wage “safe zones” as defined by the Kaitz index, which is the the minimum wage as a share of the median wage. (A minimum wage falls within a safe zone if it does not incentivize employers to employ fewer workers. Generally, the more precarious a local labor market, the lower the minimum wage threshold for remaining in a safe zone. Most minimum wages internationally, through political and stakeholder negotiation, fall between 40–60 percent of the median wage. A wage subsidy allows us to stretch beyond that because disemployment effects don’t apply. How far to stretch beyond that is a judgment call. We offer 80 percent as a starting point, but one could make the case for more or less.)

Calculated using the Current Population Survey’s Outgoing Rotational Group across 2024.

Critics may be concerned that such a policy will allow firms to cut their pre-subsidy wages. But this will only be true to the extent that the policy succeeds at its goal of increasing the number of people working. That bringing people into the labor market will put downward pressure on pre-subsidy wages is an inherent feature of labor supply policy. Doing so while maintaining at least the same post-subsidy wage that workers receive is an inherent feature of a wage subsidy specifically.

We opt to define the base wage at the federal minimum both out of convenience and because the $7.25 level exceeds the minimum requirement of being greater than the maximum achievable subsidy amount, conditional on the base wage. If we were to define the base wage, in relation to the median hourly wage of hourly workers, we would need to select a share of the median hourly wage such that the subsidy was always less than the base. If we start from ((H⋅0.8)−W)⋅0.8, where H is the median hourly wage and W is the employer-provided wage, then we can calculate the share of H such that ((H⋅0.8)−W)⋅0.8=W. Let w = W/H, giving us ((H⋅0.8)−wH)⋅0.8=wH. This reduces down to give us a value of w = 0.356. So long as the base wage is greater than 35.6% of the median hourly wage, the barrier to fraud holds. The federal minimum wage sits at 36.25% of the median hourly wage.

Setting the base wage equal to the federal minimum wage has the added benefit of making it easier for policymakers, the public, and employers themselves to understand the logic of the wage subsidy itself.

See “Measuring the Cyclicality of Real Wages: How Important is Composition Bias?” by Gary Solon, Robert Barsky, and Jonathan A. Parker; and “Who Suffers during Recessions?” by Hilary Hoynes, Douglas L. Miller, and Jessamyn Schaller

Assuming 40 hours per week and 50 weeks per year.

The EITC has been shown to predominantly pull women, and especially single mothers, into the labor market. The effect tends to stop at the participation margin though (Meyer, 2002). Some hypothesize that this is due in part to constraints on the choice of hours worked, particularly for low-wage workers. Alternatively, the targeting mechanism being income, rather than wage, implies that the decision is dependent on both wage and hours, rather than hours alone. See Labor Supply at the Extensive and Intensive Margins: The EITC, Welfare, and Hours Worked, by Bruce D. Meyer, American Economic Review, vol. 92, no. 2, May 2002, (pp. 373–379)

See Pissarides, Christopher A. Equilibrium unemployment theory. MIT press, 2000 for more details on labor market matching models and reservation wages. Also, see Barnichon, Regis, and Andrew Figura. "Labor market heterogeneity and the aggregate matching function." American Economic Journal: Macroeconomics 7.4 (2015): 222-249 for a detailed analysis on the role of heterogeneity across agents and labor markets in search models.

In economics terms, our proposed wage subsidy operates by shifting the labor supply curve out through an increase in the wage. It does not explicitly shift out the labor demand curve. Instead, by shifting out the labor supply curve, an increased quantity of work occurs thanks to an expanded set of employer-employee matches.

“Work requirements for safety net programs like SNAP and Medicaid” (Economic Policy Institute)

“Effective Marginal Tax Rates for Low- and Moderate-Income Workers” (Congressional Budget Office)

One study found that a hypothetical family living in DC would actually have seen no financial gain from an increase in wage income from $11,000 to $65,000 of earned income. Ilin, Elias, and Alvaro Sanchez. "Mitigating Benefits Cliffs for Low-Income Families: District of Columbia Career Mobility Action Plan as a Case Study." FRB Atlanta Community and Economic Development Discussion Paper 1 (2023).

For an overview of negative spillovers from tariffs, for example, see: Separating Tariff Facts from Tariff Fictions. For examples of how Buy American mandates increase the cost of trains, see: Why Free Trade in Rolling Stock is Good.

Bartik, T.J., 2019. Making sense of incentives: Taming business incentives to promote prosperity. WE Upjohn Institute.

Great post. I've though a wage subsidy was better than a UBI for some time, although you don't hear much about it. I'm glad you discussed EITC because that is most commonly referred to as a wage subsidy. I also think it would be great to have a follow up with estimates of how much this would cost and how you would restructure other poverty programs.

Two questions: 1) what about someone who has one job with a wage above $16 and is thinking about getting a second job with a wage below $16 in order to supplement their income. Would they get the full wage subsidy on the second job. Would you need to do a true-up at the end of the year?

2) Let's say an employer is currently paying workers $14.25 / hour for a job. This wage subsidy goes into effect. Why wouldn't the employer immediately cut the pay to $7.25? Then with the subsidy, the worker is left unchanged, but the cost to the employer is nearly cut in half? You could say, maybe workers would complain to prevent this or the law would be such that it could prevent it. But maybe that happens initially, but what about in equilibrium?

This is an intriguing idea. Although one issue I have, wouldn't any raises that an employee gets between $7.25 and $16.00 be effectively taxed at a marginal rate of 80%, as the take home wage only increases by 20%? Granted, it still may be better on the marginal tax rate issue than other types of subsidies like the EITC.